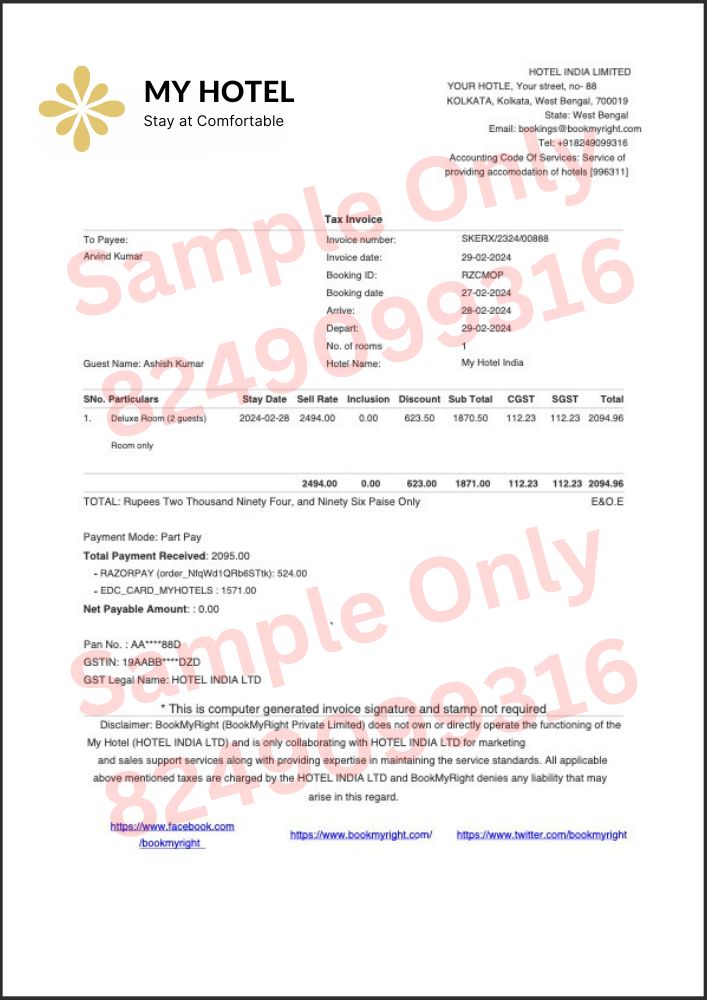

Original Hotel Bill For Claim

GST Approved Bills

100% Authentic Invoice

Complete Reimbursement Support

Zero Cancelation fees

My Billing Details

Features

Varified

Invoice

Dedicated

Manager

All India

Service

Our Process

Contact us

Contact us and Share necessary information to generate your Hotel bills

Approved your Bill

We will Create Hotel Invoice and share them for cross-checking and approval.

Payment us

After cross-checking & approving the invoice you can initiate the payment to us.

Final Bill Sent

we will share the softcopy by email and the hardcopy by courier to your address.

Original Hotel Bills for Claim by BookMyRight

Are you searching for an original and authentic hotel bill for reimbursement? If so, you are in the right place. BookMyRight is a service provider that helps you access multiple services under one roof. With years of experience, BookMyRight continues to develop, collaborate, and expand its services, adding certified vendors every month. If you need a hotel stay or a hotel bill for reimbursement, we can generate one for you online within just 30 minutes.

Our dedicated team is highly responsive and committed to helping you find the best hotel for your needs, as well as hotel bills for claims. Once you inquire about a hotel, our team will promptly contact you, gather essential documents, and generate a hotel bill tailored to your requirements—covering pricing, dates, city, area, and more.

BookMyRight features an advanced setup and skilled professionals, equipped with modern billing software. We not only assist you in finding the right hotel but also offer additional services such as cab and taxi bookings, packing and moving services, logistics, transportation, and more.

With our authentic services and 100% GST-approved hotel bills, BookMyRight is here to support you throughout the process—ensuring your bill is approved by your company and that your reimbursement amount is successfully credited to your bank account.

Currently, we can help you with the below services:

BookMyRight Hotel Bill Service Comparison with Others:

| Feature | BookMyRight Bills For Claim | Other Hotel Bills |

|---|---|---|

| Pan India Hotel Network | ✅ Coverage Across All Major Cities | ❌ Limited City Coverage |

| 100% GST-Compliant Hotel Bills | ✅ Proper Tax Invoice Provided | ⚠️ Unreliable or Incomplete Bills |

| Instant Digital Delivery | ✅ Bills Delivered Within Minutes | ⚠️ Delayed or Manual Process |

| Customized Bill As Per Requirement | ✅ Tailored as per Company Policy | ❌ Fixed Format Only |

| Verified Hotel Partner Network | ✅ Only Verified Hotels | ⚠️ Random or Unverified Sources |

| 24/7 Support for Urgent Needs | ✅ Round-the-Clock Assistance | ❌ Only During Working Hours |

| 100% Confidential & Secure Process | ✅ Your Data is Safe With Us | ⚠️ Risk of Data Leak or Misuse |

| Affordable Pricing Plans | ✅ Budget-Friendly & Transparent | ⚠️ Expensive or Hidden Charges |

| Real-Time Order Tracking | ✅ Know Your Bill Status Anytime | ⚠️ No Tracking Facility |

| 100% Claim Approval Rate | ✅ Designed to Match Reimbursement Criteria | ❌ High Rejection Risk |

| Dedicated Claim Consultant | ✅ One-on-One Claim Assistance | ⚠️ No Personalized Guidance |

| No Physical Stay Required | ✅ Virtual Bill Generation Possible | ❌ Physical Stay Mandatory |

| Multiple Payment Options | ✅ UPI, Cards, Net Banking, Wallets | ⚠️ Limited Payment Methods |

Hotel Bills for Claim

Travelling for work is very common for high-profile jobs and IT job holders which leads to hotel bills for claim and car service. During any company traveling it is very essential to keep all the hotel bills for claim or reimbursement. Sometimes when a company is relocating you permanently apart from hotel bills for claim you may need packers and movers bills for claim and traveling bills also.

A list of information must be included in Hotel Bills for Claim

The hotel bill for claim or reimbursement is a simple and convenient process for both the employee and the company. If your company is sending you to a different location for a meeting, webinar or for any other reason you have to stay in the hotel and collect the hotel bill for claim and submit it to your company to refund the amount.

For a hotel bill for claim you will have to submit a single invoice copy which must include the below information:

The above list is mandatory on a hotel bill for claim. Apart from this, a few other information may include a hotel bill for claim such as payment method, company PAN no, hotel bank account details, hotel logo etc. If you are booking any hotel via any third party service provider such as Tripadvisor, yatra or agoda they may have generated the hotel bill for claim on behalf of the hotel and their name, terms and other information will be there.

If you are booking a hotel or generating hotel bills for claim for your reimbursement our expert will make sure all the information has been maintained properly so that it will help you for a smooth claiming process from your company. Our export will also help you in all possible until your reimbursement is completed.

GST charges and their importance in Hotel Bills for Claim:

From 1st July 2017, the Indian government has implemented GST (Goods Service Tax). It is a single taxation system triggered on boot goods and services in India, replacing multiple indirect taxes. If you are taking any hotel service there are different GST price is involved:

GST is compulsory for any service or goods selling industry. If you are taking a hotel service or hotel bill for claim 12% or 18% GST is applicable on your bill. A GST number on a hotel bill for claim is very important, it proves a hotel's authenticity and follows the Indian government tax section.

Documents you need to provide at the time of hotel Check-in

When you reach the hotel for check-in you have to provide certain documents before check-in as per the government role of India. If you have booked a hotel via any third party or want to book a hotel directly via walk-in each time you have to provide the below information to book a hotel and to get the GST-approved hotel bills for claim:

These are basic details you may ask by the hotel. There are few optional questions asked by the hotel acceptability such as coming from the city, how many days he/she wants to stay etc.

Understand the hotel bill for claim submission process for reimbursement

Getting a hotel bill for claim and submitting it for reimbursement is very simple but it may be a time-consuming process and while it's an essential part of the experience, managing hotel bills for claim can be a daunting task. From keeping track of receipts to ensuring compliance with company policies, the process can quickly become overwhelming. That's why let's understand the hotel bill for claim reimbursement in a simple step-by-step process.

Step 1 : After your hotel checkout and payment process collect the hotel bill for claim.

Step 2 : Crosscheck the hotel bill for claim with all necessary information filled or not with GST information before leaving the hotel. If anything is wrong, a spelling mistake or information is missing, request the help desk person to correct it.

Step 3 : Upload the hotel bill for claim along with supporting documents to HR within the deadline.

Step 4 : Wait for HR verification and approval notification

Step 5 : After your HR approval the bill amount will hit your given bank account.

Important Points to Remember When Claiming Hotel Bills for Claim

When submitting hotel bills for claim for reimbursement, it's crucial to follow certain guidelines to ensure a smooth and hassle-free process. Keep these key points in mind:

- Verify your hotel bills for claim thoroughly and cross-check all necessary documents before submission.

- Understand the submission process and your company's reimbursement policy to avoid errors.

- Ensure timely submission of your hotel bill for claim before the deadline to prevent delays.

- Keep a digital or physical copy of your hotel bill for claim for future reference.

- Regularly follow up and check notifications for updates on the reimbursement process.

- Submit original, authentic documents and maintain transparency with your company's terms.

By keeping these important points you can make the claiming process smooth and super easy. Having prompt action and transparent documentation always leads the reimbursement process fast and successful.

How to Check the Authenticity of Hotel Bill for Claim?

If any hotel or resort is missing any required information mainly if GST is missing or having wrong GST number is auspicious or fake. To identify a fake packers and movers GST invoice, analyze properly and cross check the given GSTN number on the Online GST portal.

Read all the terms and conduction, especially payment terms carefully and if anything is suspicious contact company support directly for clarification.

Why BookMyRight for your Hotel Bill for Claim?

BookMyright is one of the most dynamic and rising hotel service providers in India. We are offering the best and world-class hotel room service from verified and authentic hotels across different cities in India.

Once you share your staying requirement we proactively find the best hotels for you under your budget with authentic hotel bills for claim. BookmyRight can provide billing service below service currently:

Our fast and easy billing system can help you to generate all sets of documents with a unique billing number instantly and share your soft copy via email in 2 minutes and Our representative can give you a hard copy also. If you want a hard copy anywhere in India our team can mail the hard copy which can be reached within 3 working days at your doorstep.

Choosing BookMyRight company for your hotel bill for claim guarantees a hassle-free and reliable staying experience with complete customer support until your reimbursement process is completed. You can trust our service, billing system and dedicated customer support.

How to apply for duplicate hotel bills for claim after you miss the original one?

If you have misplaced your original hotel bill for claim then no worries you can reapply for the same invoice from your service taken company. If you have taken service from a reputed and authentic hotel booking company such as BookMyRight then you can apply online for the duplicate copy or 2nd copy of your invoice. Our team will pull out your bill from CRM using your information and send you free within one working day. If you want a hard copy it may take 4 to 5 working days to deliver your hard copy at your destination.

A hotel bill for claim can be used for company reimbursement or sometimes it can be used for Tax savings during ITR filing at the financial year-end. So sometimes an invoice may get missing but if you have taken service from us we have not only given you a hard copy but also shared with you a soft copy of the hotel bill for claim in PDF format to your email ID. But still missing the original invoice is no more a headache. A single call or online application can deliver your invoice again to your doorstep.

Our city wise Hotel Bill for Claim service

We have covered and offered hotel services with hotel bills for claim in all major cities of India. Here are the cities where we are offering service

Clients Says

A selection of listing verified for quality

I needed a genuine and original hotel bill for a claim, and BookMyRight made it super easy. The team is very proactive and made the entire document-related process smooth and fully online. Within 10 to 15 minutes, I received my hotel bill for the claim. Highly recommended for anyone looking for genuine online hotel bills for reimbursement!

Debasish K

Pune

As per my requirement, the bill was delivered within 2 working days of my confirmation. The price is very reasonable, and thanks to the authentic GST hotel bill, my claim was settled effortlessly. BookMyRight also helped me in every possible way to generate the hotel bill for the claim. The team is friendly and professional—super impressed with their service!

Swatik Roy

Kolkata

I was looking for an original hotel bill to submit to my company, and luckily I came across the BookMyRight hotel bill service. After filling out the form, their team contacted me, and after providing all the details, my bill was generated online within 2 minutes. I submitted it and received my reimbursement. Thanks!

Abhishek Singh

Delhi

I found BookMyRight online and was skeptical at first, but they exceeded my expectations! They provide genuine hotel bills and ensure 100% GST compliance. The service is quick and reliable—perfect for anyone needing a hassle-free reimbursement process.

Rahul Mishra

Mumbai

BookMyRight provided me with an original hotel bill that was accepted without any hassle. Their team is super helpful and ensures complete transparency. If you’re looking for a smooth reimbursement experience, this is the service to trust!

Mamali Datta

Bangalore

FAQs

If you need a hotel bill for a claim you can contact us at 8249099316 we can generate genuine bills at an affordable price instantly.

If you are looking for an instant hotel bill BookMyRight can help you with the same. Contact us at 8249099316 for an Instant hotel bill generation.

So, the hotel bill is taxable under GST.