Your packers & movers bill For claim is one click away

GST & IBA Approved Bills

100% Authentic Invoice

Complete Reimbursement Support

Zero Cancelation fees

My Billing Details

Features

Varified

Invoice

Dedicated

Manager

All India

Service

Our Process

Contact us

Contact us and Share necessary information to generate your bills

Approved your Bill

We will Create all 6 sets of documents and share them for cross-checking and approval.

Payment us

After cross-checking & approving the invoice you can initiate the payment to us.

Final Bill Sent

we will share the softcopy by email and the hardcopy by courier to your address.

Original Packers and movers bill with GST and other essential documents

Are you searching for a genuine packers and movers bill for claim? If yes, then BookMyRight Packers and Movers is your ideal solution. We have built a professional system, integrating advanced CRM software, automated billing, and technology-driven moving processes, all designed to enhance customer satisfaction. Over the years, BookMyRight has refined its procedures to deliver a seamless packers and movers bill experience.

When you choose our packers and movers services, our dedicated and skilled team ensures a smooth relocation process for your home, office, vehicle, pets, plants, and more. We not only provide efficient shifting services but also ensure you receive a proper packers and movers bill for claim. To enhance user experience, BookMyRight Packers and Movers Bill offers comprehensive support until your claim process is successfully settled.

With a 100% genuine GST bill and trusted shifting services, we operate in major Indian cities, including Bangalore, Hyderabad, Pune, Mumbai, Delhi, Chennai, Kolkata, Bhubaneswar, and across India.

Our experienced professionals handle every move with precision and efficiency. Over time, we have refined our CRM system to facilitate a hassle-free billing and documentation process. The BookMyRight Packers and Movers bill offers a streamlined claim process, recognized for its accuracy and reliability.

List of information must be included in a packers and movers bill format!

The shifting process is lengthy and involves multiple services, vendors, and professionals such as company managers, packing staff, truck drivers, and unloading personnel. This results in several essential documents. However, when submitting a packers and movers bill for claim, not all documents are required. Below is a list of optional and mandatory documents that form part of the Packers and movers Bill.

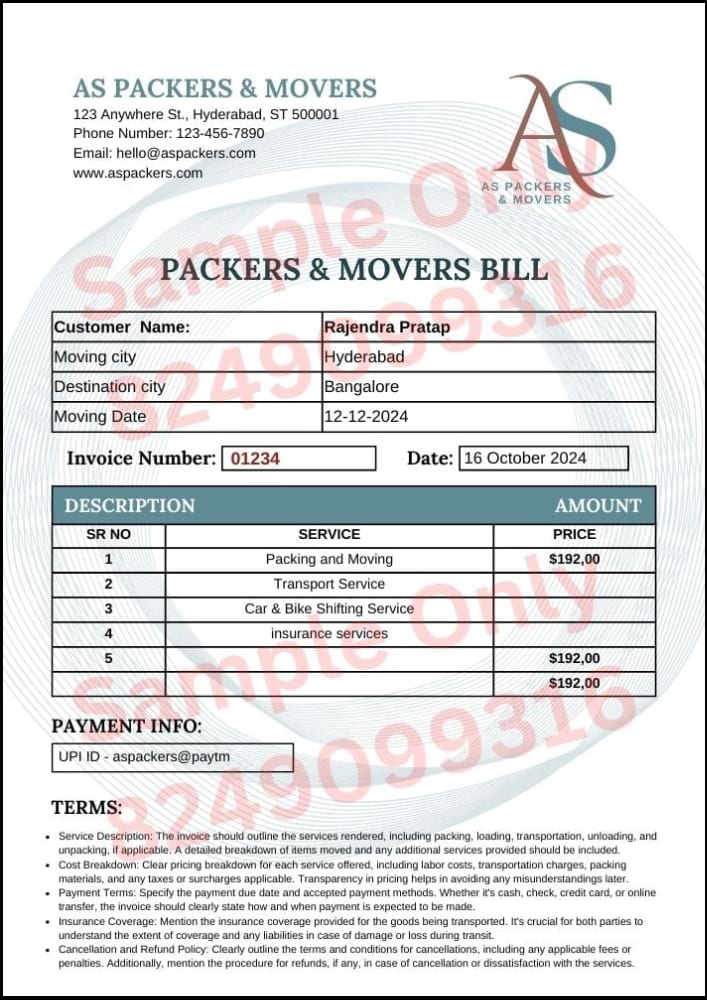

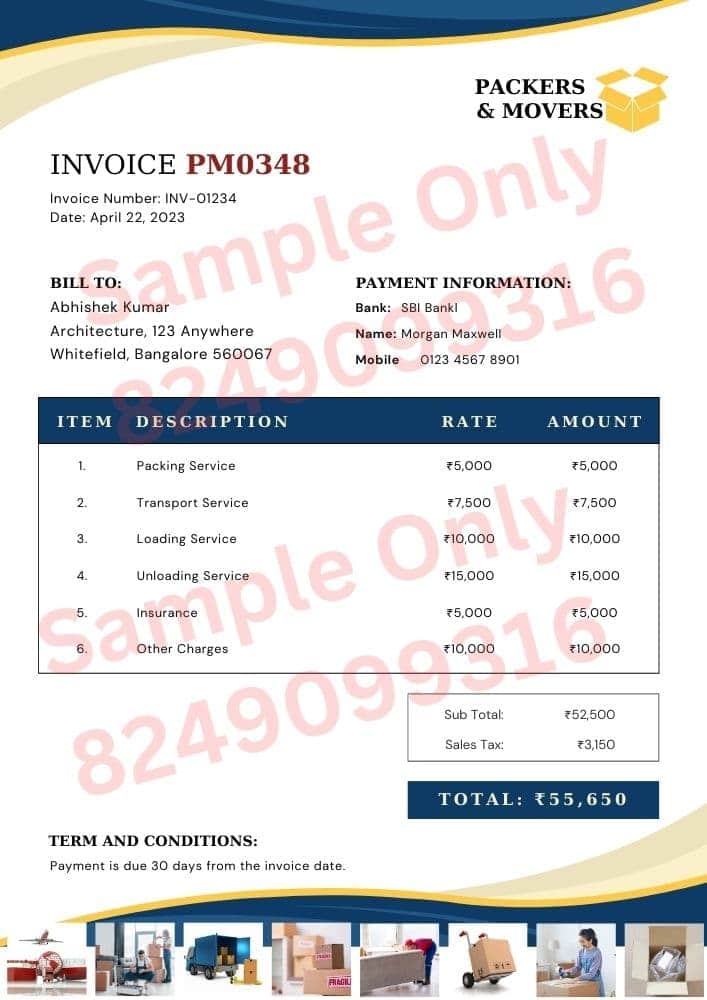

Bill or GST Invoice Copy:

This is the most crucial document required for the claim process. The amount mentioned in this invoice is used for reimbursement calculations. It includes all charges related to shifting services. The GST number and company seal must be clearly visible on the invoice.

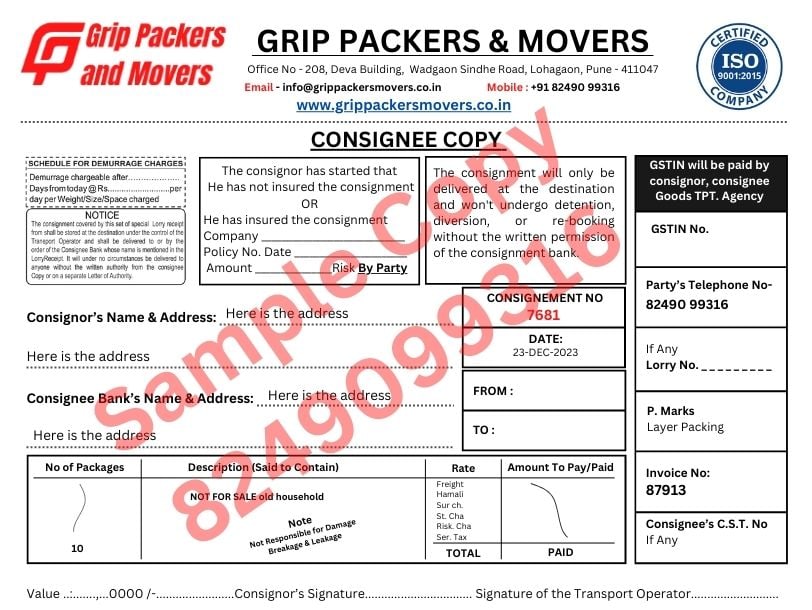

Consignee or Bilty or LR Copy:

Also known as the LR copy, this is an important document in your move. It contains critical details such as customer information, source and destination addresses, truck details, and a unique docket number.

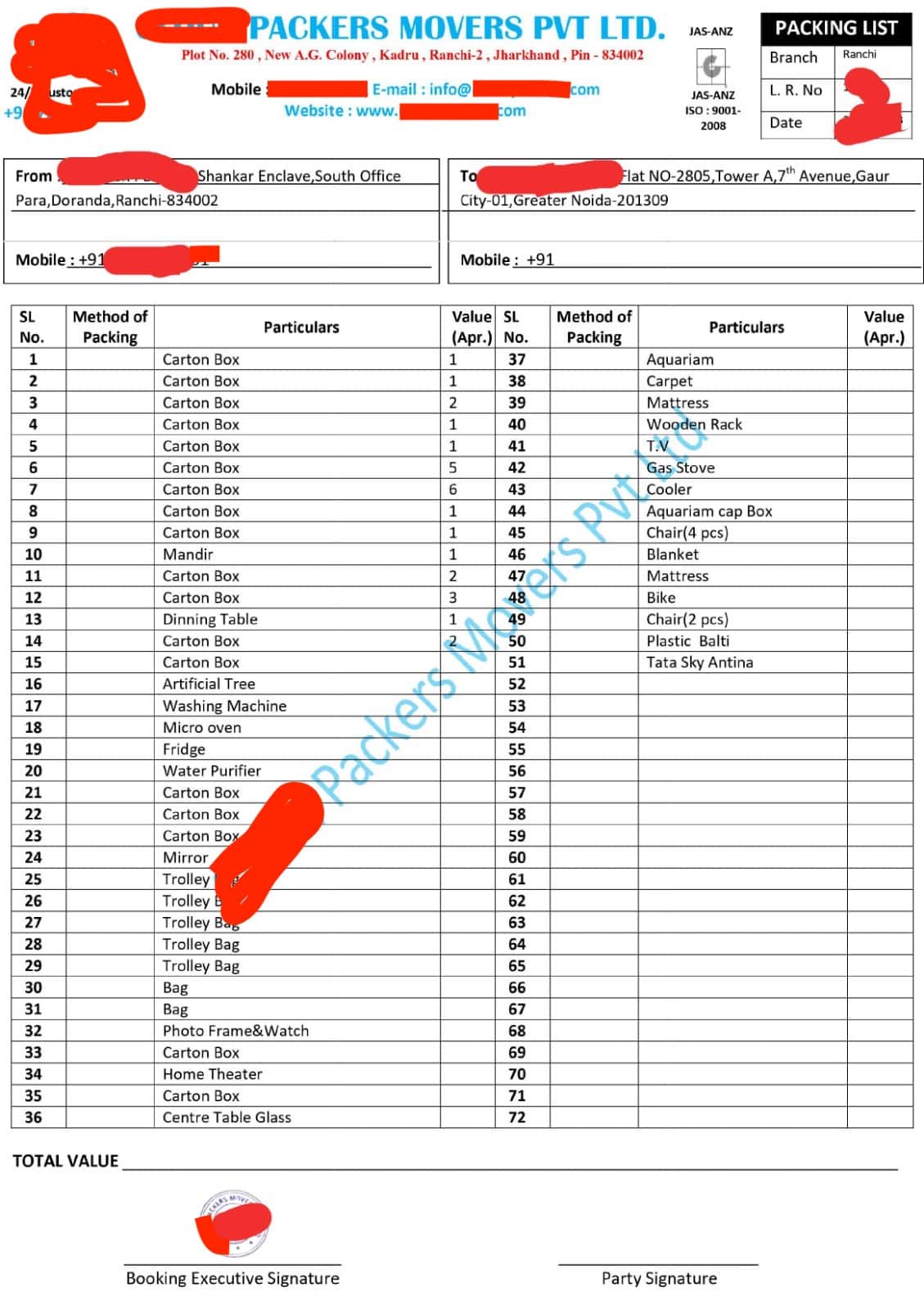

Item List or Article List:

An itemized list records all packed goods and their serial numbers. It helps verify items upon arrival and includes the declared value of goods, which aids in processing insurance claims.

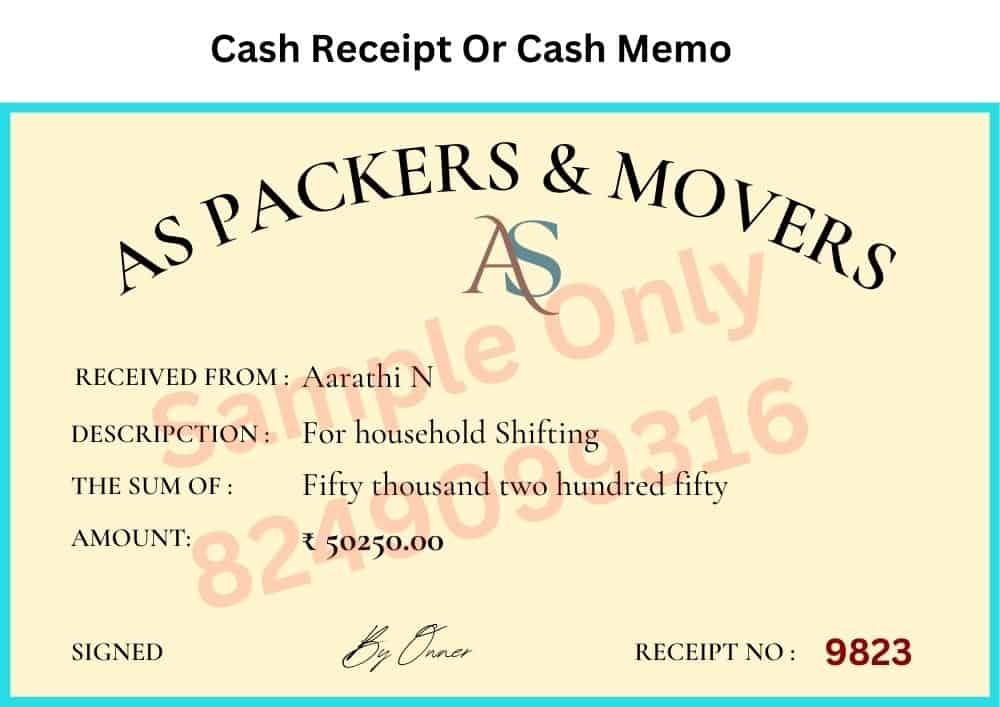

Money Receipt or Receipt Memo (Optional):

A money receipt acts as proof of payment for the Packers and Movers Bill amount. Though optional, it can serve as an additional supporting document during the claim process.

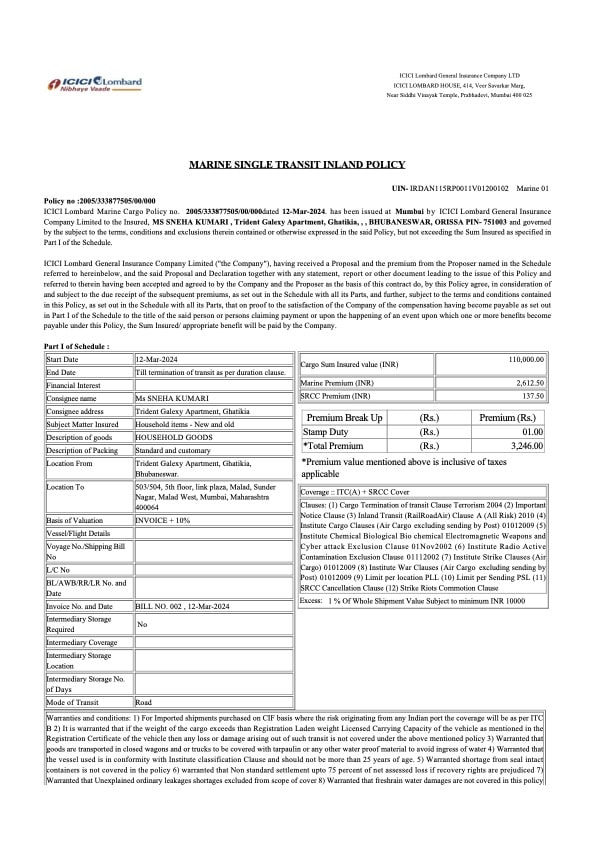

Insurance Copy (Optional):

Reliable Packers and Movers Bill for claim services, like BookMyRight, recommend taking insurance for household goods during transit. Insurance acts as financial protection. If you opt for insurance, include the insurance copy when submitting the bill for claim.

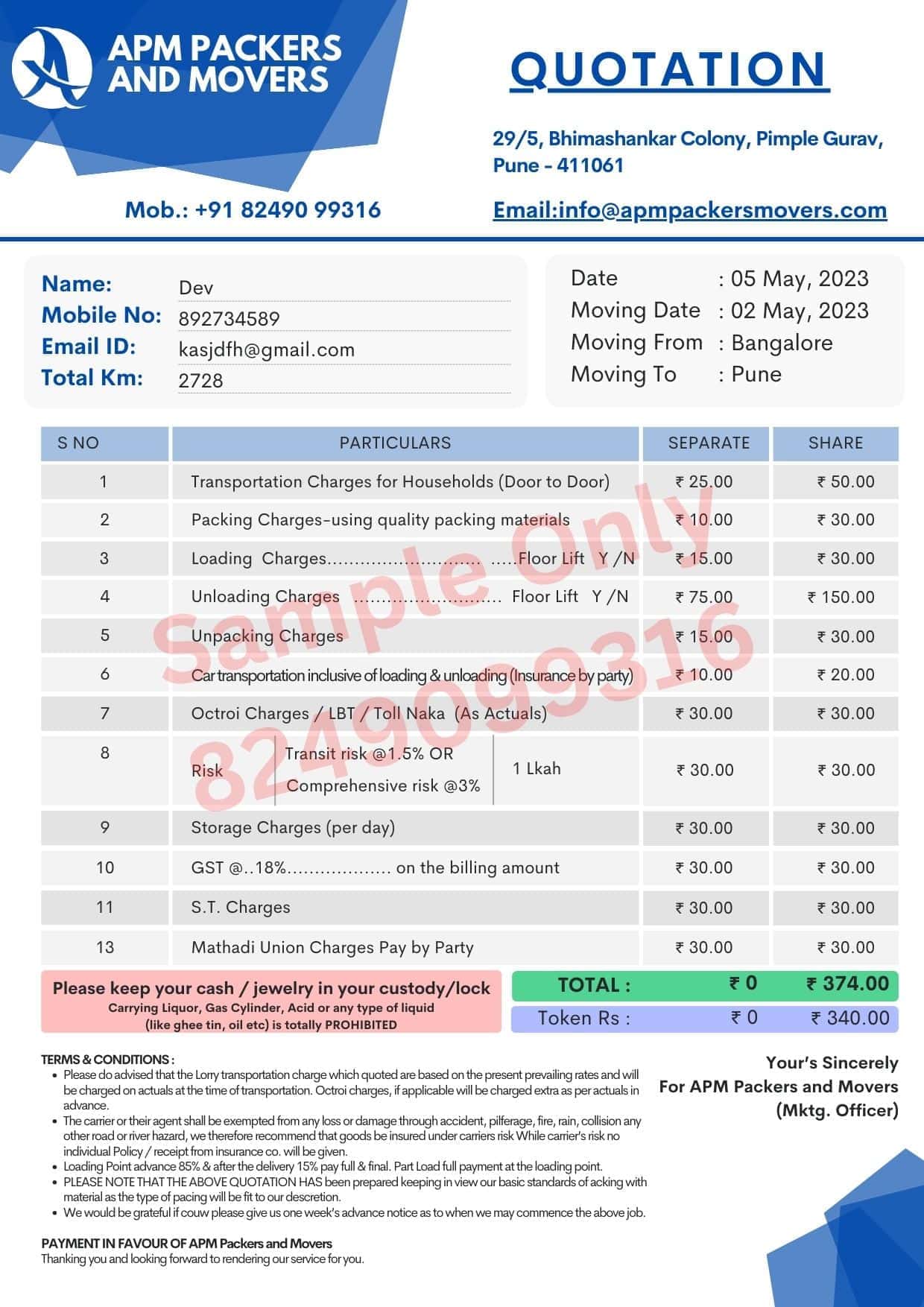

Quotation (Optional):

A quotation is the first document movers provide after inspecting goods. It outlines the estimated cost, moving date, required manpower, and additional details.

Certification and Licensing Required for Packers and Movers to Generate Bills for Claim

When hiring packers and movers, it is always advisable to choose reputable service providers to ensure a smooth and hassle-free claim process. Book My Right allows customers to compare service quality, reviews, and BMR scores to find trustworthy packers and movers bill for claim services. You can hire GST-approved, government-licensed, and IBA-approved packers and movers for authentic billing and claim processing.

To verify the legitimacy of a packers and movers bill for claim, check the following:

- Company has a valid GST registration number.

- Visit the company office for verification.

- Check their Google listing and customer reviews.

- Ensure nationwide presence and reliable customer support.

- Verify years of experience and contractual agreements.

- Confirm if they have their own transport system.

Once verified, request necessary documentation such as driver’s ID, transport vehicle registration, PAN details, TAN details, and GST certification. Keeping copies of these documents ensures future legal protection if needed.

Invest time in selecting genuine packers and movers for a stress-free move. Alternatively, you can rely on Book My Right for verified house shifting services with authentic packers and movers bill for claim assistance.

Required Documents for a Packers and Movers Bill

When engaging with packers and movers for claim, certain documents may be required to facilitate the billing process and claim approval.

Common documents requested include identity proof, residential proof, and utility bills. If transporting a vehicle, you may need to provide vehicle registration and insurance copies.

If paying online or via check, proof of payment might be required. For transit insurance claims, submit the insurance copy along with an itemized goods list and declared value.

Providing clear documentation ensures timely processing of a packers and movers bill and avoids delays. Establishing proper communication prevents claim rejections and billing complications.

GST and Its Importance in Packers and Movers Bill

GST plays a vital role in the packers and movers bill for claim process. A genuine relocation company, such as BookMyRight, includes GST in invoices, ensuring compliance with tax regulations. Companies lacking GST registration may not be legally authorized to issue valid packers and movers bills.

Understanding GST Rates for Packers and Movers Services

India introduced GST (Goods and Services Tax) on July 1, 2017, simplifying tax structures and replacing multiple indirect taxes. GST is categorized into different tax slabs—0%, 5%, 12%, 18%, and 28%, each affecting moving costs differently.

0% GST on Packers and Movers Bill

Goods related to farming, such as seeds and organic fertilizers, qualify for zero GST to support agricultural development. Some customers may apply Reverse Charge Mechanism (RCM) to pay GST directly, provided they hold a valid GST number.

5% GST on Packers and Movers Bill

If opting for transportation-only services, the 5% GST slab applies. However, if a customer avails packing, loading, insurance, or additional services, the GST rate increases to 18%.

Note: The 5% GST rate is applicable only for individual transport services (B2C customers).

12% GST on Packers and Movers Bill

Corporate clients opting for transportation-only services are charged 12% GST. If additional services such as packing, loading, and unloading are included, the GST rate rises to 18%.

Note: The 12% GST rate applies only to corporate transport services (B2B transactions).

18% GST on Packers and Movers Bill

Full relocation services involving packing, transport, unloading, unpacking, assembling, etc., fall under the 18% GST slab.

This GST rate applies to both B2C (individual customers) and B2B (corporate clients).

28% GST on Packers and Movers Bill

Luxury goods transportation, such as gold, silver, and high-end vehicles, attracts 28% GST. However, most packers and movers avoid handling high-value luxury commodities. Currently, BookMyRight does not transport luxury goods.

Packers and Movers Bill from IBA-Approved Transporters

IBA stands for Indian Banks' Association. If you require an IBA-approved packers and movers bill for claim, the transporter must be certified by IBA. To obtain IBA approval, a moving company must meet specific criteria, including fleet requirements, service reliability, and professionalism.

An IBA-approved packers and movers bill follows a standardized format and includes an IBA certification number. You can verify IBA-approved transporters by visiting the official IBA Approved Transport List. This page allows customers to search for valid IBA transporters using their IBA number, state, operator code, or city name.

Note: A packers and movers bill for claim issued by an IBA-approved transporter must contain a valid GST number, with GST charges applied as per government tax slabs.

Choosing an IBA-approved packers and movers service guarantees credibility and reliability in relocation and billing. BookMyRight has partnered with multiple IBA-approved transporters across India, ensuring a smooth claim process for packers and movers bills for claim.

Documents Required When Claiming Packers and Movers Bill

If you are a government employee or corporate professional and relocating to a new city, you may be eligible for a packers and movers bill reimbursement. To initiate the claim, specific documents must be submitted along with the Packers and movers Bill.

Mandatory Packers and Movers Bill Documents:

- Packers and Movers Bill

- Bilty or LR Copy

- Item List

Optional Packers and Movers Bill Documents:

- Quotation Copies

- Money Receipt

- Insurance Copy

Note: Some organizations require three sets of quotations for verification before selecting a moving company. BookMyRight Packers and Movers can provide three quotations from different companies, allowing organizations to compare pricing and service records.

Step-by-Step Guide for Packers and Movers Bill Reimbursement

While claiming a packers and movers bill for reimbursement, different companies may follow varying procedures. However, the fundamental steps remain the same:

Step 1: Obtain all necessary billing documents from the packers and movers company.

Step 2: Carefully review and organize supporting documents.

Step 3: Submit the Packers and Movers Bill along with required documents to HR for verification.

Step 4: Wait for approval—once validated, HR will notify you.

Step 5: After approval, the reimbursement amount will be credited to your account.

Key Points to Remember When Claiming a Packers and Movers Bill for Reimbursement

- Verify the Packers and Movers Bill and ensure all necessary documents are included.

- Understand the submission process and company policies to avoid errors.

- Submit the bill before the deadline for smooth processing.

- Keep a photocopy or digital copy of all documents before submission.

- Follow up with HR regularly to track the progress of your claim.

- Ensure all provided documents are authentic and transparent.

How to Verify the Authenticity of a Packers and Movers Bill?

Before submitting your packers and movers bill for claim, it is essential to verify its authenticity. A genuine Packers and Movers Bill includes:

- Valid GST number

- Official company address

- Unique docket number

- Authorized company seal and signature

- Customer details and contact number

- Company logo and brand certification

How to Identify a Fake Packers and Movers GST Invoice?

If a Packers and Movers Bill lacks required details—especially a valid GST number—it may be fake. To verify authenticity:

- Cross-check the GST number on the Online GST Portal.

- Review the terms and conditions, especially payment clauses.

- Contact the moving company directly for clarification.

Why Choose BookMyRight for Packers and Movers Bills?

BookMyRight is a leading packers and movers service provider in India, offering verified and authentic packers and movers bills for claim assistance. We provide:

- Trusted relocation services from verified moving companies.

- Instant billing with six sets of documents containing a unique docket number.

- Soft copies via email within minutes and hard copies mailed within three business days.

- Dedicated customer support until reimbursement is successfully processed.

City-Wise Packers and Movers Bill Services

We offer shifting services and packers and movers bills across major Indian cities. Here are the locations where we provide packers and movers bill services:

How to Apply for a Duplicate Packers and Movers Bill If You Misplace the Original?

If you have lost your original packers and movers bill, don’t worry! You can request a duplicate copy from your service provider. If you chose a reputable and verified packers and movers company, such as BookMyRight, you can conveniently apply online for a duplicate Packers and Movers Bill for claim.

Our team retrieves your bill from our CRM system using your provided details and sends it to you free of charge within one working day. If you require a hard copy, it may take 4 to 5 working days to be delivered to your destination address.

A Packers and Movers Bill is crucial for company reimbursements, and it can also be used for tax savings during ITR filing at the financial year-end. If you used our services, you would have received both a hard copy and a soft copy (PDF format) via email. Even if the original invoice is misplaced, a single call or online request ensures that your duplicate packers and movers bill is delivered hassle-free.

Clients Says

A selection of listing verified for quality

I used this service mainly to get a genuine Packers and Movers bill for claim submission at work. The invoice included GST details and was formatted exactly as required. My HR department processed the reimbursement without any follow-ups. Bookmyright team also help me all possible way. Great service for working professionals!

Rituraj Kumar

Bangalore

Recently, I shifted from Pune to Delhi and took a Packers and Movers bill for claim from BookMyRight. The process was very simple, and I received a genuine and authentic bill like a real Packers and Movers invoice. My reimbursement was also completed successfully.

Smira Gupta

Delhi

I was looking for a genuine, GST-approved Packers and Movers bill for claim and found this website. I took their service at a very reasonable price and submitted the bill for my company’s tax-saving reimbursement. Everything was handled smoothly. The best part is Dev made every possible effort to get my reimbursement processed.

Diljit S

Chennai

I recently used their relocation service and needed a proper Packers and Movers bill for my company’s reimbursement. The team provided GST-compliant invoices and ensured all supporting documents met my company’s verification requirements. Their responsiveness and professionalism made the claim process smooth and hassle-free. I highly recommend them for anyone needing valid bills for official claims.

Subhujit Roy

Kolkata

After relocating for a job transfer, I had to submit a shifting bill to my employer. This company made it simple — I received a valid GST invoice along with service verification support. Their coordination was excellent, and I got my reimbursement approved in less than a week. For anyone looking for relocation bills for official claims, this service is completely dependable.

Mukesh B

Mumbai

FAQs

If you want to download packers and movers bill samples in PDF format click the link below to download free sample bills:

If you have paid the GST amount while shifting your household goods then it will be repaid to you through your reimbursement process. In Order to claim your GST and billing amount Keep the original bill with the GST details as proof.